Banking* built for specialty crop growers

Earn more on your cash, offset rising input costs, and end the crop-cycle cash crunch

We'll notify you as we open new spots.

Thombar is a financial technology company, not a bank. Banking services provided by i3 Bank, Member FDIC (established 1928).

.png)

Why Thombar?

Named after Thomas Barbour Lathrop, the financier who reshaped US agriculture by funding the introduction of thousands of new specialty crop varieties. Thombar carries his spirit forward, using modern finance to unlock resilience and innovation for American specialty growers today.

Built for the specialty crop season, not the banking season

Higher checking rates, lower financing friction, and tools built for the cash-flow realities of fruit, vegetable, and nut growers.

1% to 2.75% Annual Percentage Yield** on your checking

Turn idle cash into real interest income while maintaining your liquidity

$30,000+ in annual savings

Exclusive discounts with leading ag suppliers, equipment, and service providers to protect your margins every season

Access to up to $150K credit line (coming soon)****

Apply once online and, if approved, unlock ongoing access to working capital when you need it — no repeated paperwork, no branch visits

FDIC insured up to $3M

12x more protection than traditional banks

$0 annual fees

Benefit from our transparent pricing

What could up to 2.75% APY do for you?

See how much more you make with Thombar

Don't see your bank here? Add the bank name and your annual checking APY to compare

That's just your yield. Thombar members also save thousands each year through exclusive grower perks from inputs to software to in-field services

Based on available rates advertised online as of 11/4/2025

Your perks package

Over $30,000 in annual savings

As a Thombar member, you get exclusive access to discounts from the vendors and partners you already work with. From equipment to inputs, labor management to logistics—we've negotiated savings that add up to real money back in your operation. Learn more

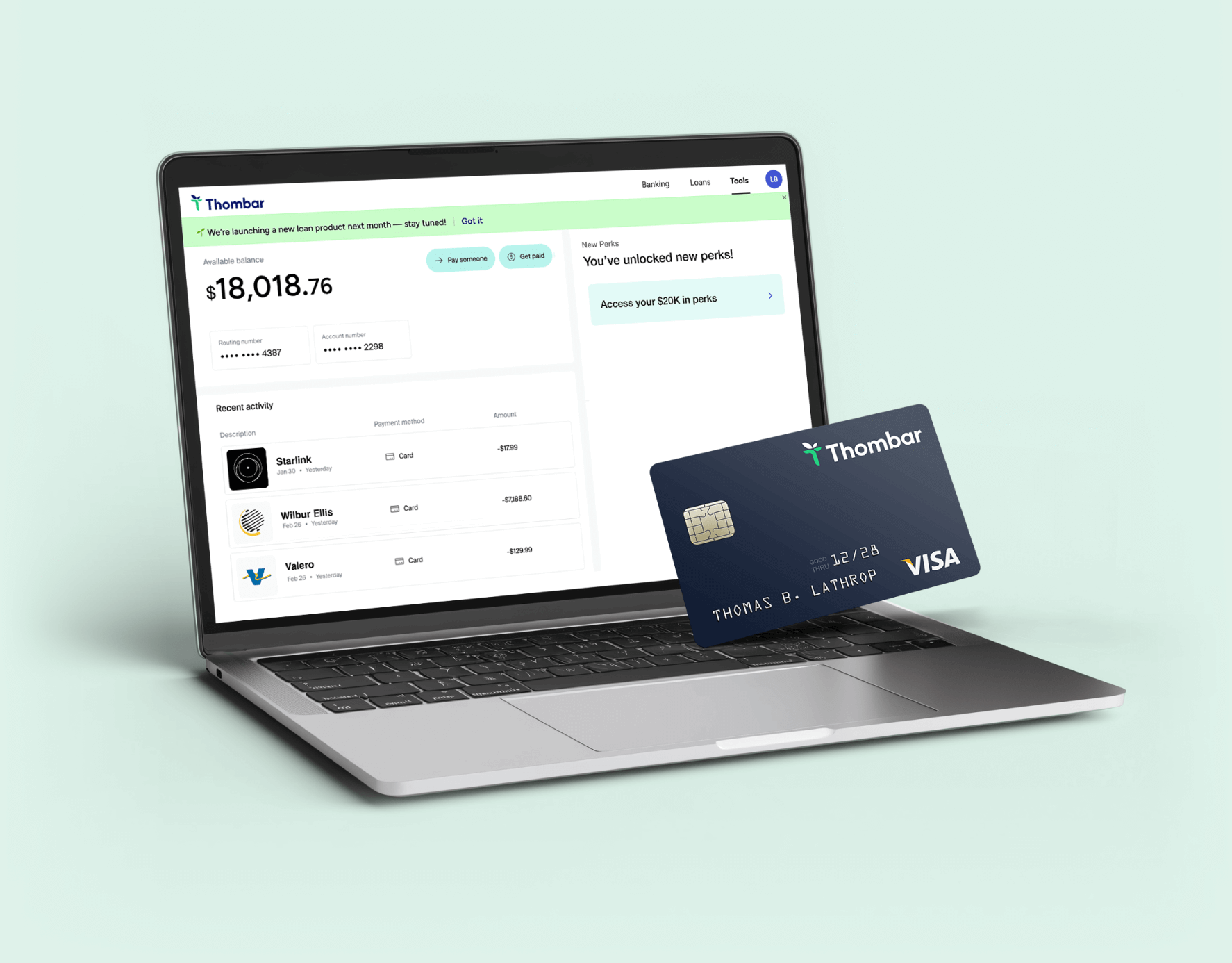

Complete banking suite

Everything you need to manage your specialty crop operation, all in one place. To see our complete list of features, click here.

Physical and digital debit cards

High-yield checking designed for agricultural cash flow with no minimum balance requirements.

No fees at 55,000+ ATMs

Withdraw or deposit cash for free*** at over 55,000 ATMs

Multi-user access and controls

Add team members as authorized users

ACH/Wires

Free 1-3 day ACH, $10 domestic wires

Checks

Mobile check deposits and mail physical checks direct from your online account

Accounting integration

Sync transactions directly to and from Quickbooks

Thombar vs. a traditional bank account

See how Thombar stacks up against traditional banking options

Banking services provided by i3 Bank, Member FDIC

Thombar gives growers the power of a modern financial hub — high-yield checking, zero hidden fees, industry perks, and FDIC coverage up to $3M — all built around your specialty crop business

Security you can trust

Your operation depends on financial security. We protect your capital with the same rigor you protect your crops.

$3M FDIC Insured

Your deposits are protected up to $3 million through our partner banks, providing peace of mind for your agricultural capital.

SOC 2 Compliant

We maintain the highest standards of data security and privacy, with regular third-party audits to ensure your financial information stays protected.

Security Audits

Continuous penetration testing and security assessments by leading cybersecurity firms to safeguard your accounts and transactions.

Our mission

Protect the domestic food supply

American specialty crop growers feed our nation and the world, yet they face unprecedented financial challenges. Consolidation in agriculture has left small and mid-sized growers without banking partners who truly understand their unique needs.

Thombar exists to change that. We believe that financial innovation should serve the people who grow our food, not just extract value from them. By providing better rates, lower fees, and industry-specific tools, we're helping specialty crop growers build more resilient operations.

When growers thrive, our food supply becomes more secure, our rural communities grow stronger, and American agriculture remains competitive on the global stage. That's the future we're building—one grower, one account, one harvest at a time.